Eksplorasi.id – Buying bargain-bin coal mines amid the worst commodity slump in a generation has turned into a savvy bet as prices of the fuel surge.

Stanmore Coal Ltd. bought the Isaac Plains metallurgical coal mine in Australia for A$1 in July 2015 from Brazilian miner Vale SA and Japan’s Sumitomo Corp. when the price of met coal, used to make steel, averaged the lowest in about a decade and just three years after the mine was valued at A$860 million ($659 million).

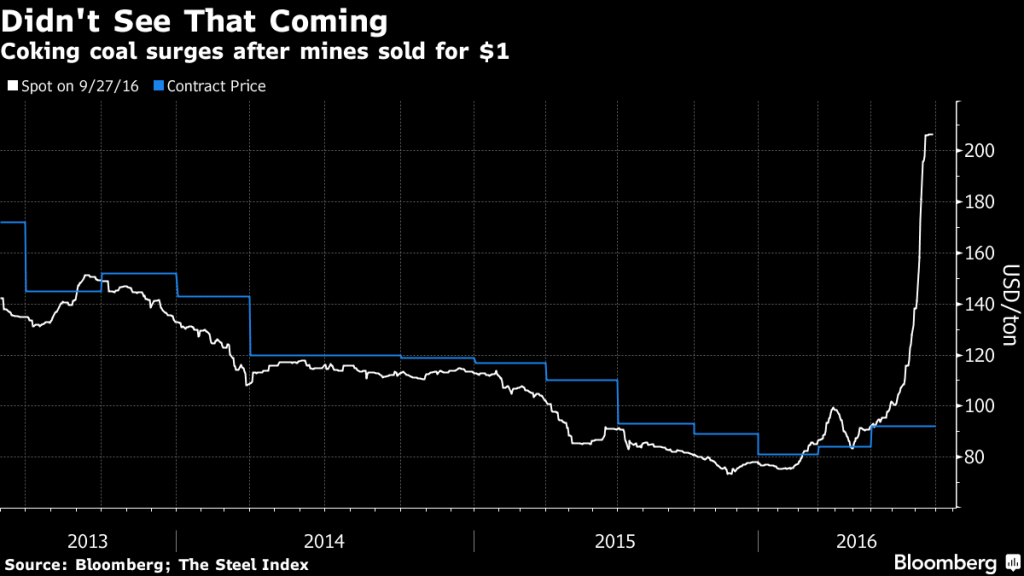

One year later, spot prices have soared above $200 a metric ton as China’s steel mills crank out record volumes while its mines slow production.

“It seems like we did get our timing right in this instance,” Stanmore Chief Executive Officer Nick Jorss said in a phone interview from Sydney. “When we bought Isaac Plains, hard coking coal was in the $70s. We’ve had pretty substantial movement since then.”

Coking coal has surged almost 170 percent this year as output from China, the world’s biggest miner, tumbles under pressure from the government to cut overcapacity even as demand from steelmakers surges. Prices reached $210.80 a ton as of Thursday, according to The Steel Index.

Stanmore, which has seen its share price double since the beginning of last month, isn’t the only miner who bought low. Australia’s TerraCom Ltd. last week completed the purchase of the Blair Athol thermal coal mine, also for A$1, from Rio Tinto Group as the world’s second-biggest miner exits some of its Australian coal portfolio. Thermal coal in Australia, while unable to match coking coal’s rally, has risen more than 50 percent this year.

‘Brave Enough’

Miners who struck deals before the recent price surge were well placed to profit from the unexpected revival, even if they’re small producers, said Robin Griffin, research director for global metallurgical coal markets at Wood Mackenzie Ltd., a consultant.

“They were brave enough to make the call to try and make it work,” Griffin said. “They wouldn’t have foreseen this spike, but they would have had a more optimistic view perhaps. So, in some respects, you could argue their gut feeling was justified.”

While the $1 headline price appears a bargain, Griffin notes the deals come with costly commitments. Stanmore is responsible for a $32 million obligation for the Isaac Plains mine, in Queensland state, while TerraCom is also on the hook for costs related to rehabilitating the mine.

Quarterly Contracts

Stanmore is targeting 1.1 million metric tons of coal a year from Isaac Plains, while TerraCom hopes to ship 2 million tons annually. Australia, the world’s largest coking coal producer, exported 186 million tons last year, according to Wood Mackenzie.

Japan’s Electric Power Development Co., which owned Blair Athol with Rio Tinto and is known as J-Power, said it decided to sell its stake to a company that was willing to recover the remaining coal resources, according to a J-Power spokesman, who asked not to be named, citing company policy. Sumitomo Corp., Rio Tinto and Vale declined to comment.

Stanmore’s Jorss expects coking coal contract prices for the fourth quarter to rise above $150 a ton, from the current quarter’s $92.50. Analysts at Macquarie Group Ltd. forecast deals will be agreed at $170 a ton, which is still far short of the record of $330 a ton in 2011.

“If they have material to sell, the funds will just roar in this quarter,” Wood Mackenzie’s Griffin said. “If prices continue into the next quarter and into the first quarter of 2017, it will look like a master stroke.”

TerraCom Chairman Cameron McRae, a former Rio Tinto executive, said there were good bargains to be found in unwanted coal assets.

“The extent of the commodity down-cycle has put a lot of miners under pressure and you’ve seen companies sell up because their balance sheets require it,” McRae said. “When you see a significant down-cycle you will always see assets come onto the market.”

Source : Bloomberg