Eksplorasi.id – China’s oil output slump shows no signs of abating as the country’s state-run energy giants hold back spending to cope with the crash in prices.

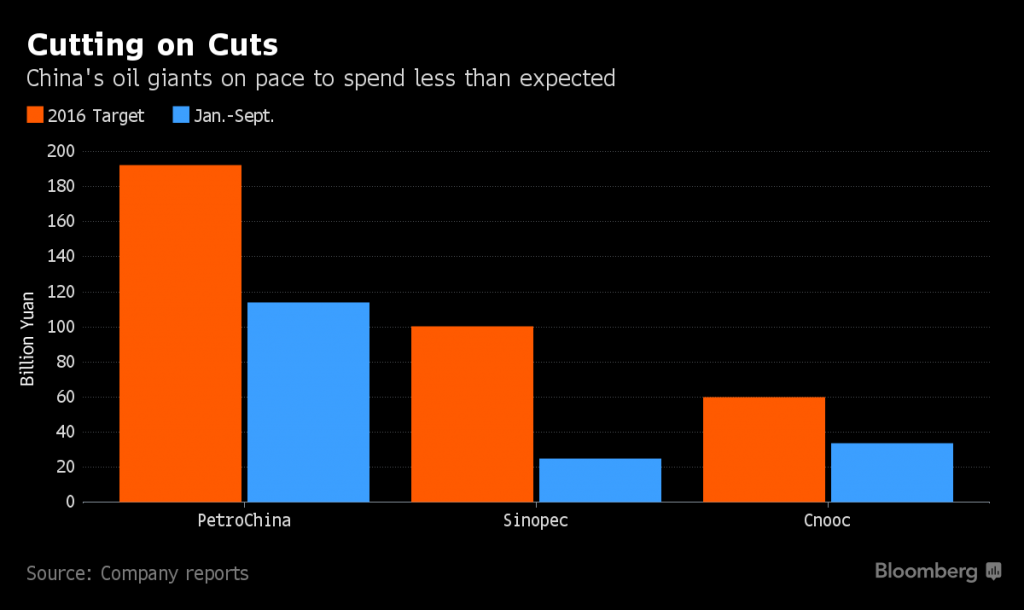

China’s Big Three producers, led by PetroChina Co., have spent about half of their 2016 capital-expenditure targets in the first nine months of the year, according to operational data released last week by the companies.

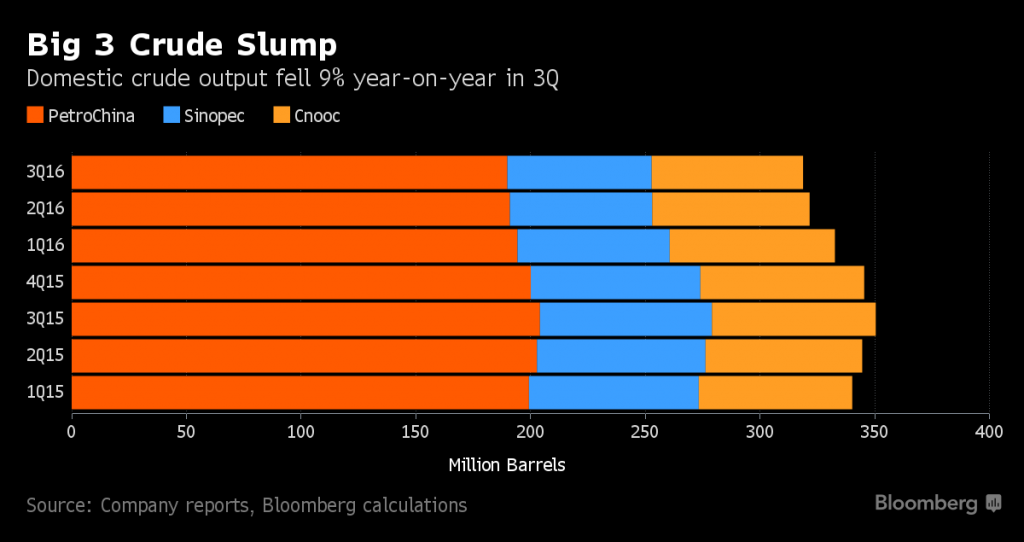

Their domestic crude output has slumped 6 percent over that period amid the cutbacks, Bloomberg calculations show. China Petroleum & Chemical Corp., known as Sinopec, has seen the largest production declines and spent the least so far this year.

“Low crude prices led to lower spending, and lower spending caused the lower output,” said Tian Miao, a Beijing-based analyst at North Square Blue Oak Ltd. “The only thing that can change the game is a substantial rebound in crude prices.”

While output drops, crude imports have surged to all-time highs as the country’s refineries are on track to process a record amount of crude this year and the government takes advantage of the slump in prices to fill emergency stockpiles.

China edged past the U.S. last month as the world’s biggest importer and the country has relied on overseas supplies for 65 percent of its needs this year, a record ratio, according to analysts at consultant ICIS China.

“The Chinese government has no problem with reduced domestic crude production as long as crude imports can be guaranteed,” Tian said. “The national duty of the Big Three in a low-crude environment is more about securing imports than producing at a loss.”

PetroChina shares in Hong Kong dropped 1.3 percent to HK$5.31 as of 9:34 a.m local time Monday, while Sinopec gained 0.4 percent and Cnooc Ltd., the country’s biggest offshore oil explorer, shed 1.3 percent. Hong Kong’s benchmark Hang Seng Index fell 0.7 percent.

PetroChina on Friday said net income during the first nine months of the year fell 94 percent to 1.73 billion yuan. Full-year results are expected to “decrease substantially” from 2015, it said in a statement.

Sinopec said Thursday profit rose 11 percent over the period as the world’s biggest oil refiner benefited from lower crude costs for its fuel-making business. Cnooc, which doesn’t release quarterly net income, reported Wednesday a 15 percent fall in third-quarter sales.

‘Significantly Underspend’

Sinopec has spent about 25 billion yuan in the first nine months of the year, down a third from same period last year and a quarter of its 100.4 billion yuan target. Domestic crude output during that period is down 14 percent.

The company may consider buying overseas assets or stakes in other projects, Chairman Wang Yupu said after the half-year results were released in August.

“The company is likely to significantly underspend the full-year budget,” Neil Beveridge, a Hong Kong-based analyst at Sanford C. Bernstein, said in a research note after the company released quarterly earnings last week.

PetroChina has spent 114 billion yuan in the first nine months of the year, down 23 percent from the same period a year ago. The company said in March that it was targeting a 5 percent decline in capital spending to 192 billion yuan.

Cnooc has reached slightly more than half its full year target in the first three quarters. The offshore explorer intends to keep its 60 billion yuan spending cap this year, Chief Financial Officer Zhong Hua said in a conference call after the sales figures were released Wednesday.

Having spent just 33.7 billion yuan in the first nine months, Cnooc will try to spend more in the last three months on improving output and preparing for new projects, he said.

China’s total crude output fell 6.1 percent in the first nine months of the year. Production can stabilize with prices around $50 a barrel and may not rebound until they are above $60, Bernstein’s Beveridge said earlier this month. Production from the Big Three in the third quarter slipped by 9 percent from the same period last year, according to Bloomberg calculations.

Source : Bloomberg