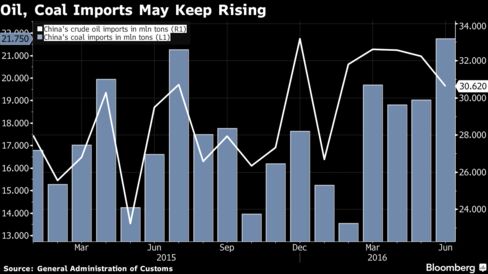

Eksplorasi.id – China’s appetite for foreign energy is as strong as ever. Growing demand from oil refiners and the continued filling of strategic crude reserves in the face of domestic production declines will support crude buying by the world’s second-largest consumer, according to analysts from Energy Aspects Ltd. and ICIS China. Coal imports will continue to rise to help fill a supply gap left by a mining slowdown.

“Crude buying will remain substantial in the second half” of the year, Michal Meidan, an analyst at Energy Aspects, said by e-mail. “This is because domestic output is declining and there will also be SPR fills of around 50 million to 60 million barrels.”

‘Flattish’ Demand

Purchases of oil from overseas surged more than 14 percent during the first six months of the year. Meanwhile, production fell 4.6 percent. China boosted coal imports to the highest in more than a year in June as a government campaign to curb overcapacity slashed domestic output by 16.6 percent in the same month.

The nation’s coal output will fall by 280 million tons this year as the government seeks to curtail industrial overcapacity, according to officials with the National Development and Reform Commission, the top economic planner. Coal imports will be sustained at more than 20 million tons a month in the second half of the year, according to Deng Shun, an analyst with ICIS China.

The strength in the nation’s import appetite contrasts with sluggish domestic demand for the fuels. The nation’s apparent oil consumption fell 0.7 percent in June from a year earlier, data compiled by Bloomberg show. China’s coal demand is set to drop by 3.4 percent this year, according to Citigroup Inc.