A German coal trader is unfazed by decade-low coal prices that pushed producers into bankruptcy as it seeks to open Poland’s first mine in four decades.

HMS Bergbau AG plans to invest more than 100 million euros ($111 million) to begin output from a mine in southern Poland by 2018, Dennis Schwindt, head of business development at the Berlin-based trader, said in an interview. The mine will be more competitive than state-backed peers and financing will be concluded after the company receives a mining license, he said.

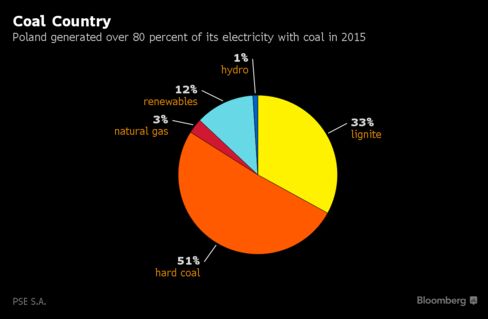

Even as investors from JPMorgan Chase & Co. to Norway’s sovereign wealth fund are cutting or halting investments in coal projects and miners filed for bankruptcy, HMS Bergbau says the fuel will be needed in power generation for decades to come. European prices slumped for a fifth year in 2015, leading Poland’s government to urgestate-controlled utilities to prop up the loss-making industry, which meets 84 percent of the nation’s electricity demand.

“Europe will operate coal-fired power plants for a long time still and this coal has to come from somewhere,” Lars Schernikau, a partner at HMS Bergbau, said in an interview in Berlin. “We believe that we’ll be competitive in Europe because of our low cost, even though overall coal use will drop.”

Poland is the European Union’s biggest producer of the fuel and the government of Prime Minister Beata Szydlo, a miner’s daughter, has promised to keep all production open in defiance of EU efforts to curb emissions of heat-trapping carbon dioxide and the industry’s mounting losses. Poland has more than 100,000 coal and lignite miners, the most in the 28-nation bloc.

The last mine to start producing the fuel was KWK Morcinek near the border with Czech Republic, where construction began in 1978. It closed down in 1998 to 2002, according to government data.

HMS Bergbau plans to open its mine in Orzesze in the Silesian coal basin about two years after it receives a license. The company is in talks for financing, which will consist of own equity, loans and possibly bonds.

HMS was founded in 1995 and employs 30 staff in offices from Berlin to Jakarta. Its founder Hans Schernikau also used to operate a mine in South Africa.

Neighboring Mine

The company benefits from having no liabilities from an existing workforce as in most Polish mines, and hopes to cut costs by agreeing a deal with JSW SA’s neighboring Krupinski mine to use some above-ground equipment and its shaft, Schwindt said. That would save HMS from digging as deep as 1,000 meters (3,300 feet) to access the fuel that is still the world’s biggest source of electricity generation.

State-controlled JSW said in November it wasn’t considering Bergbau’s offer to invest. The company hasn’t changed its position and isn’t considering Bergbau’s offer to invest as it hasn’t decided on the future of Krupinski mine, Katarzyna Jablonska-Bajer, a company spokeswoman, said by phone on Monday.

HMS Bergbau is still in talks with JSW and there are alternatives to the cooperation, Schwindt said, without giving details.

HMS Bergbau’s Polish unit Silesian Coal SA is targeting output of 3 million metric tons of steam and coking coal annually, or about 4 percent of Poland’s output in 2015. It will be sold domestically and possibly to the Czech Republic, Germany and Austria.

Australia’s Prairie Mining Ltd. also plans to to start a mine near Lublin in 2020. The company sold shares in its Polish unit to finance the project and forecasts that coal will rise to $76.40 a ton by 2020, according to a presentation in March. The benchmark European price traded at $58.50 a ton on Monday, according to broker data compiled by Bloomberg.

The EU got 24 percent of its power from coal in 2014, down from 28 percent 10 years earlier. Use of the polluting fuel may decline as the bloc aims to cut greenhouse gas emissions by 40 percent by 2030 from 1990 levels.

“As long as we’re the last ones who will shut down, we’ll still have many decades to go,” Schernikau said.

Eksplorasi | Bloomberg | Aditya