U.S. oil and gas producers are selling shares at record speed, a sharp turnaround from past years when debt markets were the industry’s favored source of cash.

There are two main reasons behind the shift, and neither is particularly bullish. First, the downturn made it tougher and more expensive to borrow. Second, using equity can help strengthen a company’s balance sheet at a time when the oil bust is dragging into its third year. The latest is Laredo Petroleum Inc. which said Thursday that it’s selling 13 million shares to repay debt and finance a recent acquisition.

“Last year was about survival,” said Jason Wangler, an analyst at Wunderlich Securities in Houston. “If you survived last year, this year is about preparing for the future.”

U.S. energy producers have raised $16 billion from share sales since the start of the year, more than half of the total $29 billion raised by the industry, according to data compiled by Bloomberg. By comparison, equity accounted for 25 percent or less of the capital raised for the past five years.

Turning from debt markets to stock sales can burnish companies’ balance sheets in two ways. The first is simple: repay and refinance debt. The second is by buying up oil and gas prospects to add assets and cash flow, which makes debt look less onerous. U.S. producers are using both.

“The whole name of the game is trying to survive until oil gets back up to $60 or $70,” said Spencer Cutter, a credit analyst with Bloomberg Intelligence. “That may take a year or two. Nobody knows.”

For more on debt investors fearing the energy sector, click here.

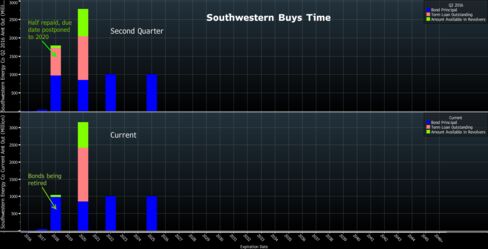

“Through a combination of asset sales, amend and extend agreements with the banks and the equity issuance, Southwestern has successfully strengthened its balance sheet,” said Michael Hancock, a company spokesman.

Another Approach

Other companies have raised equity in order to buy assets. Producers including Pioneer Natural Resources Co., QEP Resources Inc. and Antero Resources Corp. have tapped equity markets this year to finance the purchase of oil and gas prospects. This improves their debt metrics by adding cash flow and assets without borrowing more money.

Spokesmen for Antero, Pioneer and QEP did not return calls for comment.

“It’s all part of the same theme of de-levering,” Subash Chandra, an analyst at Guggenheim Securities LLC in New York, said of the share sales. “Part of that tool-kit is ‘backdoor equity,’ which adds inventory and obscures the dilution by adding something new.”

The stock market doesn’t always seem to mind the dilution. Pioneer, for example, rebounded quickly after its latest offering.

“Investors are looking at this and saying, ‘I know it’s not great now, but I think it’s going to get better in the future so I’m in,’” Wangler said. “It’s a bet on better days ahead.”

Eksplorasi | Bloomberg

Hi there mates, its fantastic paragraph concerning tutoringand fully

explained, keep it up all the time.