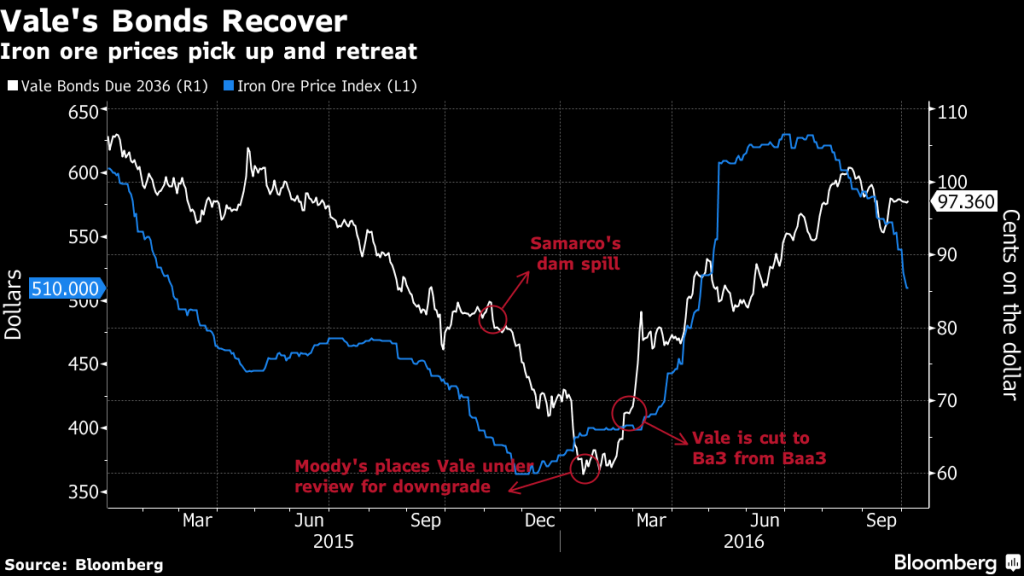

Eksplorasi.id – Vale SA is handsomely rewarding the bond investors who stuck with the mining giant when it was downgraded to junk.

Its $2.5 billion of notes due in 2036 have soared 40 percent since February, when Moody’s Investors Service lowered Vale’s credit grade.

The securities have rallied as iron-ore prices rebounded and the company announced plans to aggressively reduce its indebtedness.

The world’s biggest exporter of the material plans to divest as much as $6 billion of assets by next year to reduce net debt that swelled to $27 billion after a rout in commodity prices.

Iron-ore has jumped 35 percent in 2016 after sinking to a record low last year.

Growing investor confidence in Vale’s turnaround plans is also outweighing the exposure to unit Samarco Mineracao SA.

That company — a joint venture with BHP Billiton Ltd. — defaulted in September, 10 months after it caused Brazil’s biggest environmental disaster.

“The Samarco risks are already priced in Vale’s bonds,” said Carlos Gribel, the head of fixed income at Andbanc Brokerage in Miami. “They are doing their homework in deleveraging the company.”

Moody’s declined to comment on Vale’s rating.

Brazil’s real advanced 0.2 percent to 3.2202 per dollar at 11:29 a.m. in Sao Paulo.

Source : Bloomberg