Eksplorasi.id – They come from the same mines and are called sister metals, but investors are showing more affection for zinc than lead.

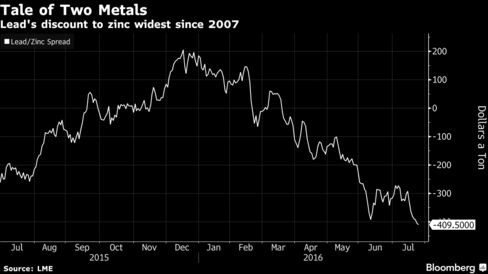

Zinc, used to rustproof steel, has jumped 40 percent this year to become the best-performing industrial metal. It has gained on concerns about shortages, while steel prices rose as policy makers around the world pledged to back growth. Lead has added just 2.9 percent and trades at the biggest discount to zinc in nine years.

While zinc has benefited from steel’s rebound, mine closures and output cutbacks, lead appears to be more adequately supplied. That’s because of more recycled material in China, the biggest user and producer, as old metal from used car batteries comes back to the market. It’s happening as demand from electric bicycles, a big reason for lead rallies in the past two decades, is slowing, Societe Generale SA said in June.

“Lead is lagging behind,” Steve Hardcastle, the head of industrial commodities client-services at broker Sucden Financial Ltd. in London, said by phone. “While zinc attracted investors on the back of mine cuts, lead hasn’t. It has been disappointing.”

The spread between the two metals was at $409.5 a metric ton on Monday, the most since August 2007.

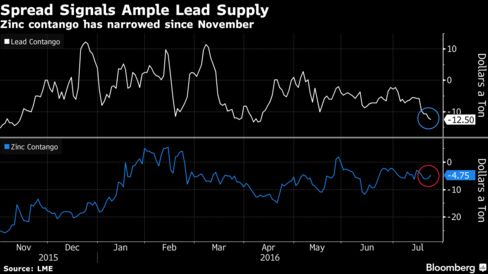

Even though Macquarie Group Ltd. expects mine output for both metals to shrink this year, contracts on the London Metal Exchange show traders aren’t concerned about supplies being as scarce for lead. The metal for immediate delivery is trading near the biggest discount to the three-month contract since mid-November. In contrast, the contango for zinc has narrowed about 80 percent over the period.

Eksplorasi | Bloomberg