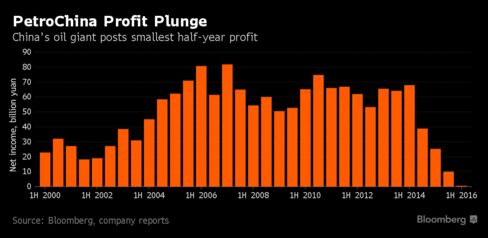

Eksplorasi.id – PetroChina Co., the country’s biggest oil and gas producer, posted its smallest half-year profit since it was publicly listed in 2000 as the crash in oil prices continues to drag on earnings.

Net income dropped 98 percent to 531 million yuan ($80 million), the state-run explorer said in a statement to the Hong Kong stock exchange on Wednesday. Revenue fell 15.8 percent to 739 billion yuan. The sale of a Central Asian pipeline network helped the company eke out a profit and recover from its first-ever quarterly loss earlier this year.

“Low crude price is a killer for companies like PetroChina as they pretty much rely on oil incomes to make a living,” Tian Miao, a Beijing-based analyst at North Square Blue Oak Ltd. said by phone.“The performance is not unexpected and what they do in the second half hinges on whether oil can really rebound to a higher level.”

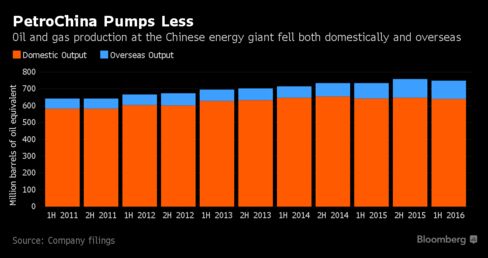

The state-owned explorer’s total global crude oil and gas output rose 1.7 percent to 748.2 million barrels of oil equivalent during the first half of the year, it said on Wednesday. That’s down 1.3 percent from the second half of last year. Capital expenditures fell 17.5 percent to 50.9 billion yuan. The company declared a special dividend of 0.02 yuan a share in addition to an interim dividend distribution of 45 percent of profit.

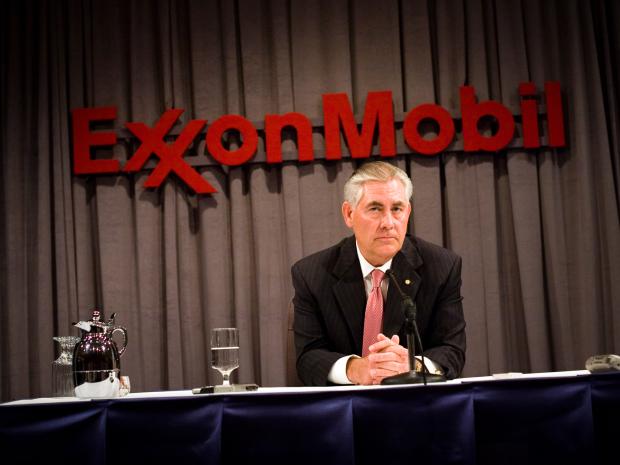

While oil prices have recovered from a 12-year low earlier this year, the crash continues to roil explorers. Exxon Mobil Corp. and Royal Dutch Shell Plc in July reported their lowest quarterly profits since 1999 and 2005, respectively. Chevron Corp. is suffering the longest earnings slump in more than a quarter century and BP Plc posted its lowest refining margin in six years.

Brent crude, the global benchmark, averaged about $41 a barrel during the first half of the year, down roughly 30 percent from the same period in 2015. Prices have fared better in the second quarter, averaging about $47 from about $35 during the previous three months.

Domestic Decline

High production costs, aging fields and low prices have resulted in a decline in China’s domestic crude output, helping drive imports by the world’s second-biggest consumer to a record. Oil producers including PetroChina and China Petroleum & Chemical Corp. have said they will shut down high-cost fields this year after prices crashed to the lowest since 2003. PetroChina’s domestic crude output in the first half of the year fell 4.2 percent from the same period in 2015 to 385.3 million barrels.

The country’s crude production in July tumbled to the lowest since October 2011 and has slipped 5.1 percent in the first seven months of the year, according to data from the National Bureau of Statistics. The drop contrasts with a 3.1 percent increase in natural gas output over the same period. While demand growth for oil has slowed, natural gas use rose 9.8 percent in the first half the year.

PetroChina and it’s parent company, China National Petroleum Corp., have sold off some assets to shore up their balance sheets to weather the crash. The company announced in November that it planned to sell a 50 percent stake in Trans-Asia Gas Pipeline Co., which builds and operates links between Central Asian countries to China’s western province of Xinjiang, to a unit of state-owned China Reform Holdings Corp. The company said Wednesday that it booked a 24.5 billion yuan gain from the sale.

CNPC said in July that it earned a profit in the first half of the year of 27.6 billion yuan, without providing details. The company will give priority to natural gas exploration and production in the second half the year and may adjust investment strategies depending on the change in oil prices, Chairman Wang Yilin in a statement last month.

The Changqing oil field, CNPC’s biggest domestic oil and gas producer, reported separately last month that it rebounded from losses earlier this year to turn a first-half profit on reduced spending. PetroChina posted a 13.8 billion yuan loss in the January to March period, its first-ever quarterly loss since listing in 2000.

Source : Bloomberg