Eksplorasi.id – Even if OPEC defies a skeptical market by implementing output cuts in full, it still won’t drain the ocean of surplus oil already pumped from the ground.

The Organization of Petroleum Exporting Countries aims to shrink the world’s bloated oil inventories with its first production cut in eight years, according to Secretary-General Mohammed Barkindo.

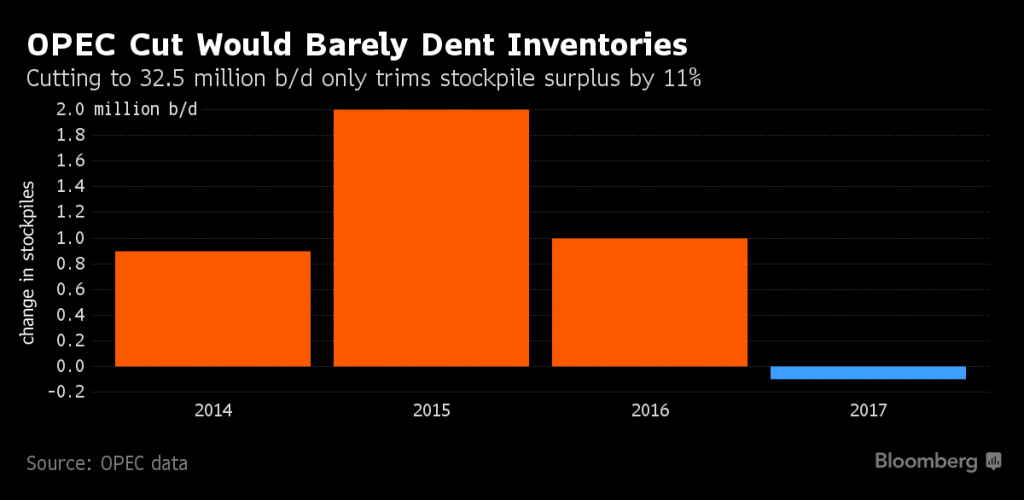

Yet the bloc’s own data show that even the maximum reduction under consideration would barely dent record stockpiles next year. That makes securing help from competitors — chiefly Russia — critical to ending the glut.

Global supplies have exceeded demand for three years straight, resulting in the accumulation of an oil-inventory surplus big enough to fill about 160 supertankers.

While cutting output to the lower end of the range adopted last month would stop a further expansion, it would curb the existing excess by just 11 percent next year, the group’s data show. If the organization can’t make a deal with Russia, there’s a risk of another price collapse, according to Commerzbank AG.

“Would the proposed production range actually reduce brimming global inventories?” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. “The signs are not encouraging. Based on current available data and past precedents, next year will unlikely see the supply-demand balance tighten.”

OPEC agreed on Sept. 28 in Algiers to reduce output to a range of 32.5 million to 33 million barrels a day, and determine how much each member should cut by its next meeting on Nov. 30.

The accord helped push oil prices to a 15-month high above $50 a barrel earlier this month, although they have subsequently fallen amid doubts the group will follow through on its pledge.

Unsustainable Inventories

The Algiers accord is “primarily geared” toward bringing down “the high, unsustainable level of inventories that have built up over the last two years or so,” OPEC’s Barkindo said on Oct. 18.

Saudi Arabian Energy and Industry Minister Khalid Al-Falih, who represents OPEC’s most powerful member, said the following day he’s confident the organization will succeed.

Many analysts agree, with International Energy Agency Executive Director Fatih Birol predicting the deal will hasten the re-balancing of supply and demand in 2017.

World oil inventories will decline by 270,000 barrels a day next year if the cuts are implemented, or stay roughly unchanged if OPEC keeps output steady, according to Harold “Skip” York, vice president of integrated energy at consulting firm Wood Mackenzie Ltd. in Houston.

Still, OPEC’s own data indicate that cutting production to the bottom of the proposed range would only have a superficial impact on stockpiles.

Long Road

If OPEC reduces output to 32.5 million barrels a day — a cut of 900,000 a day from September levels — it would be pumping slightly less than the amount needed to meet demand in 2017, the group’s monthly report from Oct. 12 shows.

Inventories would contract as a result, but only by 36.5 million barrels over the course of the year, a negligible impact on a stockpile surplus the group estimated at 322 million barrels above the five-year average in August.

If OPEC doesn’t act to reduce stockpiles next year, Societe Generale’s price forecasts would probably have to be revised lower, Mike Wittner, head of oil-market research, said in an e-mailed note. Over the first three quarters of 2017, the bank currently sees Brent averaging $55 a barrel and West Texas Intermediate at $53.50.

Brent rose 1.5 percent to $50.74 a barrel on the London-based ICE Futures Europe exchange at 3:45 p.m. local time on Thursday. WTI was at $49.87.

“It will be a long road,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas in London, who predicts OPEC action wouldn’t pare inventories until the third quarter of next year.

Persuading Russia

Cutting output by enough to achieve OPEC’s objective may then hinge on persuading rivals such as Russia to join in. The contribution of such countries is “every bit as critical” in stabilizing the market as any intervention by OPEC, Saudi Arabia’s Al-Falih said.

Yet Russia has given mixed signals on its willingness to collaborate, with President Vladimir Putin suggesting in Istanbul on Oct. 10 that the country was prepared to reduce supply, only to add two days later that it would at most refrain from further increases.

“We are working on different options and mechanisms of coordination between OPEC and non-OPEC,” Russian Energy Minister Alexander Novak said Monday in Vienna after talks with OPEC officials.

The discussions addressed “concrete” output levels, he said, declining to elaborate. Output cuts are not an option for Russia, the nation’s envoy to OPEC said on Tuesday, according to Interfax.

Russia has offered to help OPEC in the past, only to renege on its promises. Raising expectations of a pact now — after attempts earlier this year and in 2014 failed — heightens the risk of a price collapse if no agreement is reached, according to Commerzbank.

“For all the grand promises Russia and OPEC are throwing around, the economic and political obstacles to their cooperation are just too high,” said Eugen Weinberg, head of commodities research at Commerzbank in Frankfurt. “The danger for them is what happens when the market realizes they’ve been bluffing.”

Source : Bloomberg