Eksplorasi.id – Vale SA and BHP Billiton Ltd.’s Brazilian mining joint venture is seeking capital injections from its owners as it runs out of cash after a deadly accident halted output, people with knowledge of the matter said.

The iron-ore company’s cash will expire by August and it needs contributions from Vale and BHP to stay afloat, two people said, asking not to be identified because talks are private. Samarco, as the venture is known, has already started exploring ways to restructure about $1.6 billion in bank loans and may seek to put off bond payments until it can resume operations, the people said.

Mining has been halted since November, when a tailings dam collapse killed as many as 19 people and contaminated waterways. After reaching a multibillion-dollar settlementwith the government in March, the company hoped to secure licensing to resume operations this year, but probably will have to wait until 2017. Meanwhile, stockpiled ore has run out and the venture is fighting civil claims and prosecutors’ efforts to overturn the March settlement.

Samarco declined to comment on any discussions with its owners. BHP declined to comment on Samarco’s financial position and Vale referred to comments made by Investor Relations Director Rogerio Nogueira on June 16 that it would only inject money if there’s a prospect for Samarco to restart.

The venture’s debt isn’t guaranteed by its owners, which don’t intend to make payments on the company’s behalf, one person familiar with the matter said.

Samarco hired JPMorgan Chase & Co to help it with bank restructuring talks, BHP hired Rothschild & Co., Vale has Moelis & Co. advising it, while banks holding the mine’s debt are working with FTI Consulting Inc., people with knowledge told Bloomberg earlier this month.

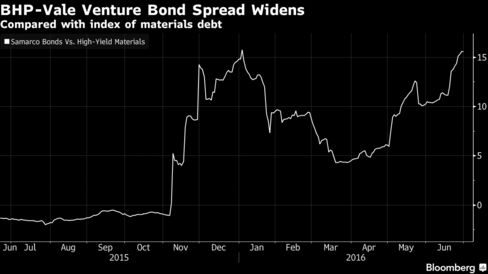

The venture’s $2.2 billion of bonds have coupon payments scheduled for as early as September. The notes lost investors 20 percent in June, the worst performance among debt issued by mining and metal companies tracked by Bloomberg. Bonds due 2022 fell 6.1 percent to 35.78 cents on the dollar at 2:39 p.m. in New York, the lowest since Jan. 21.

Samarco reported about 15 billion reais in debt ($4.7 billion) at the end of 2015 and 1.8 billion reais in cash. Its obligations include about 328 million reais of payments this year and 324 million reais in 2017, the company said.

“Running out of cash makes for a good reason to restructure bonds,” said Omar Zeolla, an analyst at Oppenheimer & Co. in New York. “But I think shareholders would support the company. Annual interest expenses are not all that high.”

Samarco’s March settlement includes 4.4 billion reais over the first three years and about 12 billion reais over 15 years, with Vale and BHP offering to finance any potential shortfalls. On Thursday, Brazil’s Superior Court issued an interim order suspending a lower court ratification of that settlement and reinstating a 20 billion-real civil claim. BHP said it would appeal the Superior Court decision. Samarco was scheduled to lay off about 1,200 employees after June.

Eksplorasi | Bloomberg | Juta