Eksplorasi.id – Two Latin American countries in need of massive investments to boost drained state coffers have become locked in an escalating competition to attract Big Oil’s interest in their deep-water oil reserves.

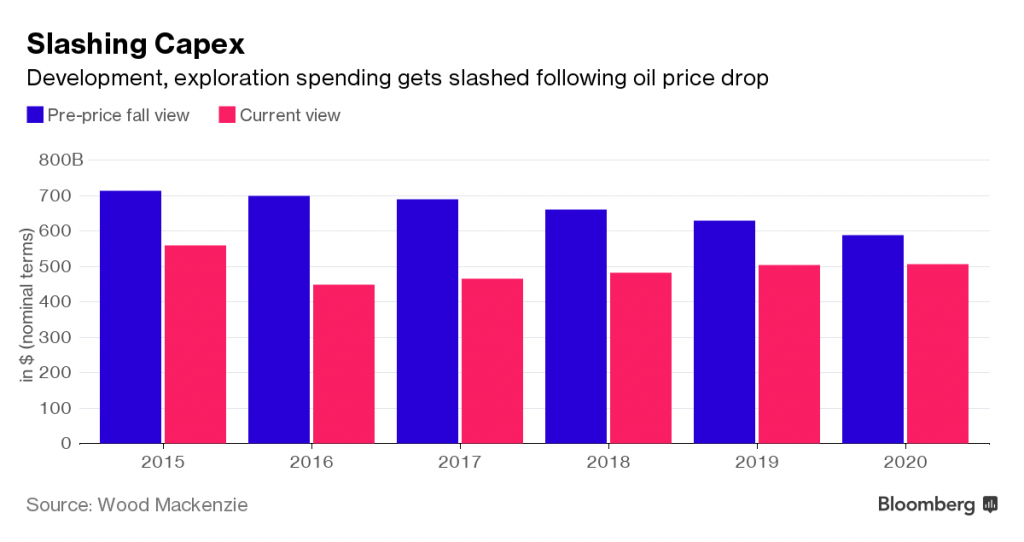

Mexico and Brazil, the region’s two biggest economies, each want a slice from a shrinking pie as international drillers limit their investments during a time of depressed oil prices. Exploration spending by major explorers in 2015 dropped by half from a year earlier to $7 billion, according to a Wood Mackenzie Ltd. report in September that also predicted industry spending would continue to be curtailed through the end of the decade.

To compete, Brazil this month scrapped a rule calling for its state-controlled driller to be the operator in all of its fields, controlling at least a 30 percent stake. The following week, Mexico said it would let operators bid individually in the first deep-water joint venture with state-controlled Petroleos Mexicanos, rather than in groups of two or more. In both cases, the initial rules were seen as limiting options for potential bidders.

Mexico and Brazil “are chasing the same dollars,” said Scott Monette, business development manager at the petroleum resource consultancy Gaffney Cline & Associates. “We are starting to see the first salvo of rigorous competition between those countries.´´

Mexico will hold its first-ever deep-water auction Dec. 5, offering up 10 areas in the Perdido area, near its maritime border with the U.S., and in the southern gulf’s Cuenca Salina, as well as a separate bid for the joint-venture with Pemex in the Trion field.

Brazil’s tender, set for 2017, will be the second since the country unveiled tens of billions of barrels of recoverable reserves nearly a decade ago. It will include so-called “unitized” blocks that extend from already discovered pre-salt areas awarded to concession holders in the aughts, according to the head of Brazil’s national petroleum agency, Magda Chambriard.

Benefits, Questions

Each country’s offering carries major benefits, and also significant questions. Mexico’s reserves are close to the U.S. side of the Gulf, where international oil companies such as Royal Dutch Shell Plc, Chevron Corp. and BP Plc are already developing highly-productive deep-water assets, said Horacio Cuenca and Pablo Medina, Wood Mackenzie’s analysts, in a joint telephone interview. But they’re largely unexplored.

While Brazil’s pre-salt reserves are much bigger that Mexico’s and already produce some oil, they’re further from shore and would be more costly and complex to extract.

“Blocks in Brazil will require massive investment in the short to medium term, whereas in Mexico you have exploration blocks and you will probably not see capital expenditure in billions of dollars until early to mid-next decade,” Medina said by telephone from Houston.

Technical Expertise

Additionally, companies could struggle to evaluate the geology and reserve potential of both opportunities at the same time, according to Monette. “You are not only competing for the same dollars, but the same technical expertise in order to be able to vet them,” he said.

The good news is that both countries have seen fit to sweeten their proposals, said Bob Fryklund, the chief upstream strategist at IHS Energy, in a telephone interview. “So they are both definitely high on peoples’ radars,” he said.

Both countries have have faced setbacks over the past several years as they’ve opened up their oil fields to private investment. Mexico’s first oil auction in July last year, offering access to shallow water exploration, which ended almost eight decades of state monopoly in the sector, saw only two of 14 blocks awarded amid collapsing oil prices, spurring Mexico to gradually sweeten bid terms in subsequent tenders.

Brazil’s auction for its massive pre-salt Libra field three years ago — the first tender in the pre-salt region since it transitioned to a production-sharing model in 2010 — drew interest from only one group.

Although Libra is the biggest discovery in the area, companies were put off by an expensive signing bonus of some seven billion dollars and onerous national content requirements, which Brazil is now looking to make more flexible.

Growth Forecasts

Economists reduced their growth forecast for Brazil next year to its lowest level in two months, underscoring how Latin America’s largest nation is struggling to emerge from recession.

They see growth in Mexico slowing to 2.1 percent this year from 2.5 percent in 2015 as the Mexican government has repeatedly slashed its gross domestic product estimates, amid plunging oil output and low crude prices.

Mexico has reacted quickly to market changes, according to Cuenca, whereas Brazil “has been slower to adjust to current environment.”

Brent crude, the global benchmark, lost 0.2 percent to $51.34 a barrel at 12:51 p.m. Singapore time.

“With the oil prices that you have and companies suffering as they are, they are just not willing to take risks unless the offer is really attractive,” Cuenca said. ”Mexico has learned to be competitive, whereas Brazil is only just beginning to realize it is not only about volumes anymore, and they are working on it.”

Source : Bloomberg